About TELx

TELx Market Participants & Incentives

Market Participants & Incentives Overview

TELx Overview

Both the SMS Network and the TELxchange are user-owned liquidity products that leverage Automated Market Makers (AMMs) to enable users to swap tokens instantly. The products enable Liquidity Providers to capture swap fees for providing self-custodial liquidity to smart contract based token reserves. Liquidity Providers may also earn TEL emissions, governed by the TELx Council, if they stake their Liquidity Pool tokens on TELx staking contracts (making them a Telcoin Association Liquidity Miner).

The diagram below shows the interaction of the key components of the TELx products:

Figure 1: TELx Overview Diagram

Working through Figure 1, and starting in the middle:

-

TELx denotes the collection of live liqudiity pools on the TELx Platform.

-

Users interact with the TELx pools, either directly or via an integrated product, paying fees to exchange one token for another. TELx is built on DeFi protocols, and anyone in the world can trade TELx markets.

-

Liquidity Miners are Liquidity Providers (people or entities providing liquidity to the underlying AMM pools) who have staked their liquidity pool tokens or NFTs in TELx staking contracts. When users swap using the pools, it is Liquidity Provider's and Liquidity Miner's liquidity which is used to facilitate these swaps. Liqudidity Providers earn fees for swaps, issued to them by the underlying AMM.

In the case of Balancer pools, Liquidity Providers earn fees proportionate to their share of the total liqudiity. In Uniswap V4 pools, fee distributions are dependent on amount of liquidity but also the range over which the liquidity is provided. This is explained in more detail later on.

Liquidity Miners also earn these fees, but earn additional TEL issuance from the TELx stakign contracst they have staked their liquidity on. Due to the permisisonless nature of TELx products anyone, including users, are welcome to provide liquidity - enabling a true user owned system.

-

The TELx Council orchestrates the above functionality. They work with Telcoin Autonomous Ops and outside providers to improve the TELx system, and they define and set rules for the Liquidity Miners, including determining TEL issuance amounts on a per pool basis to be paid from the TELx TEL Safes. The TELx TEL Safes are funded by the TEL Treasury, which is governed by the Telcoin Association Treasury Council. Liquidity Miners select 3 of the 6 seats on the TELx Council.

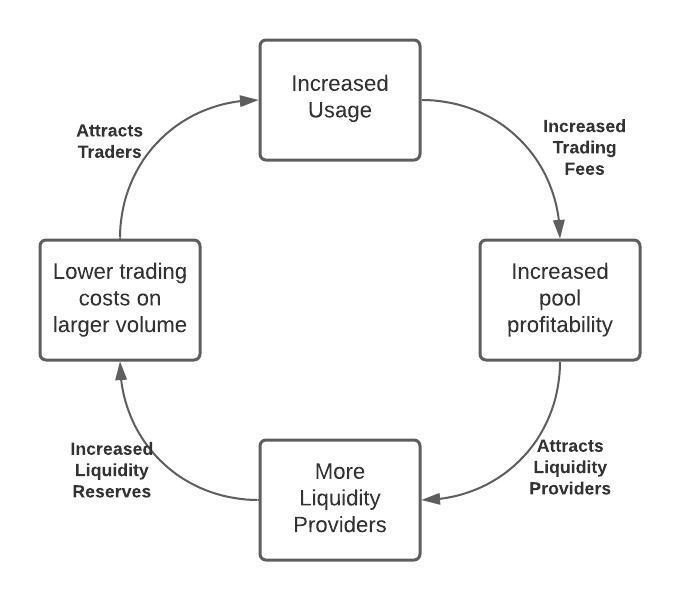

TELx incentives have demonstrated effectiveness in attracting initial liquidity providers, kickstarting the below flywheel.

Overall, the TELx infrastructure provides a sustainable system which ensures deep liquidity and enables user ownership throughout.